The Massachusetts Department of Family and Medical Leave (the “Department”) recently announced several updates in connection with the Massachusetts Paid Family and Medical Leave (“MA PFML”) program for 2025, outlined in the table below.

|

MA PFML Updates |

2025 |

2024 |

2023 |

|

Total MA PFML Contribution Rate — |

0.88% |

0.88% |

0.63% |

|

Medical Leave |

0.70% |

0.70% |

0.52% |

|

0.42% |

0.42% |

0.312% |

|

0.28% |

0.28% |

0.208% |

|

Family Leave |

0.18% |

0.18% |

0.11% |

|

0.0% |

0.0% |

0.0% |

|

0.18% |

0.18% |

0.11% |

|

Total MA PFML Contribution Rate — |

0.46% |

0.46% |

0.318% |

|

Medical Leave |

0.28% |

0.28% |

0.208% |

|

0.0% |

0.0% |

0.0% |

|

0.28% |

0.28% |

0.208% |

|

Family Leave |

0.18% |

0.18% |

0.11% |

|

0.0% |

0.0% |

0.0% |

|

0.18% |

0.18% |

0.11% |

|

State Average Weekly Wage Rate |

$1,829.13 |

$1,796.72 |

$1,765.34 |

|

Maximum Weekly Benefit Amount |

$1,170.64 |

$1,149.90 |

$1,129.82 |

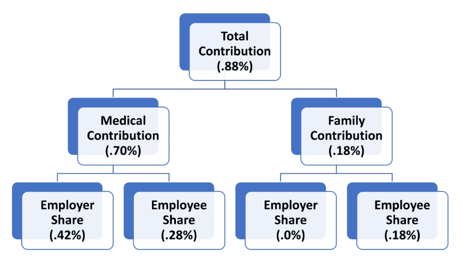

2025 MA PFML Contribution Rates

For employers with 25 or more covered individuals, this contribution of 0.88% for 2025 of eligible wages can be split between covered individuals’ payroll or wage withholdings and an employer contribution.

For medical leave, up to 40% of the contribution can be withheld from a covered individual’s wages (0.28% of eligible wages). Employers are responsible for contributing the remaining 60% (0.42% of eligible wages).

For family leave, up to 100% of the family leave contribution can be withheld from a covered individual’s wages (0.18% of eligible wages).

The diagram below from the MA PFML webpage outlines the 2025 MA PFML contribution rate splits for employers with 25 or more covered individuals:

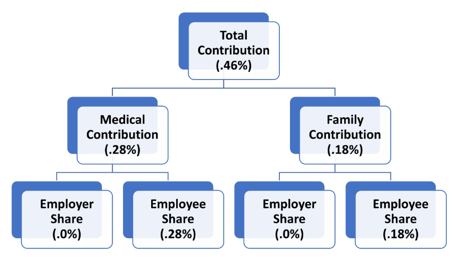

Employers with 24 or fewer covered individuals are not required, but may choose, to contribute towards the cost of employees’ MA PFML coverage.

For medical leave, up to 100% of the medical leave contribution can be withheld from a covered individual’s wages (0.28% of eligible wages).

For family leave, up to 100% of the family leave contribution can be withheld from a covered individual’s wages (0.18% of eligible wages).

The diagram below from the MA PFML webpage outlines the 2025 MA PFML contribution rates for employers with 24 or fewer covered individuals:

MA PFML Refresher

MA PFML, enacted in 2018 and fully implemented in 2021, provides paid family and medical leave benefits for covered individuals working in Massachusetts, including current full-time and part-time employees, certain former employees, as well as seasonal and contractor employees. Covered individuals are eligible for up to 12 weeks for family leave and 20 weeks for medical leave (with a combined maximum of 26 weeks in any year).

Covered Employers & Individuals

MA PFML applies to employers with one or more employees working in Massachusetts, including full-time, part-time, contractor, and seasonal employees. MA PFML follows the same eligibility criteria as Massachusetts’s unemployment insurance program.

Covered individuals for MA PFML purposes include Massachusetts W-2 employees and Massachusetts 1099-MISC contractors.

Note that for Massachusetts employers with employees working outside of Massachusetts, these out-of-state employees are not counted as part of an employer’s workforce for determining the 25-employee threshold count.

Contributions & Benefits

Contributions by covered individuals are capped by the Social Security taxable maximum, which is currently set at $168,600 for 2024.

MA PFML benefits received are based on a percentage of a covered individual’s typical wages, up to a maximum amount set by the Department ($1,170.64 per week for 2025).

Qualifying MA PFML Reasons

MA PFML can be taken for the following reasons:

- caring for one’s own serious health condition (up to 20 weeks of paid medical leave);

- bonding with a new child during the first 12 months after birth, adoption, or placement (up to 12 weeks of paid family leave);

- caring for a family member with a serious health condition (up to 12 weeks of paid family leave);

- caring for a family member who was injured serving in the armed forces (up to 26 weeks of paid family leave); and

- managing affairs while a family member is on active duty (up to 12 weeks of paid family leave).

- managing affairs while a family member is on active duty, as well as caring for a family member with a serious health condition or injury suffered during military service.

- spouse, domestic partner;

- children, including stepchildren or children of a domestic partner;

- parents, including stepparents, parents’ domestic partner, or spouse/domestic partner’s parents;

- grandchildren, including step-grandchildren, or domestic partner’s grandchildren;

- grandparents, including step-grandparents, or grandparent’s domestic partner;

- siblings, including step-siblings, and

- family members who are related through in loco parentis, custodial/non-custodial care, and/or as a legal ward.

Job Protection

Since MA PFML is job-protected leave, employers are prohibited from retaliating against employees for their use of MA PFML.

Continuation of Health Benefits

Employers are also required to continue providing and contributing to employees’ health coverage while on MA PFML. Click here for a Risk Strategies article detailing a clarification regarding the health benefits maintenance provision with MA PFML, requiring employers to maintain health benefits during their employees’ MA PFML period.

Required Employer Notices

Employers must post and distribute certain MA PFML information to their employees, including new hires, such as a workplace poster, an employee notice, and rate sheet, sample templates of which can be accessed here.

Private Plans

Employers may opt of the MA PFML contribution requirements by applying for an exemption from the state as long as their own paid family and medical leave program under a private plan (or self-insured plan) is at least as generous as the MA PFML program with the same rights and protections.

MA PFML Recent Developments

Court Case Affirming Certain Benefits Not Required to Accrue during MA PFML

On September 13, 2024, the Massachusetts Supreme Judicial Court ruled in Bodge & others vs. Commonwealth & others that MA PFML does not require employers to guarantee the accrual of vacation time, sick time, and length-of-service credit benefits during an employee’s MA PFML leave. The court’s decision declared that MA PFML “does not prevent employers from offering the accrual of benefits during leave” but employers are “not required to do so.”

This ruling did confirm that MA PFML requires employees returning from MA PFML leave to be reinstated back to the same, or equivalent, position with no loss of vacation time, sick time, or length-of-service credit benefits that the employee had already accrued when they started their MA PFML leave.

Massachusetts PFML & PTO “Top Off” Option

In late 2023, Massachusetts amended the MA PFML program to allow employees receiving MA PFML benefits from the state to supplement, or “top off,” their weekly MA PFML benefit with accrued paid time off (PTO), such as vacation, personal, and sick time, up to 100% of their average weekly wage. Click here for a Risk Strategies article with more information.

Next Steps for Employers

- Employers should update their payroll systems to reflect these 2025 MA PFML rate changes in advance of January 1, 2025.

- Employers are advised to review and revise, as necessary with employment and labor counsel, their existing MA PFML policies and practices in light of this recent Bodge court decision, which is the first of its kind ruling on MA PFML interpretation.

- Employers with MA PFML private plans may wish to assess whether the private plan option is still the best option for MA PFML.

For those employers interested in learning more about private plan options, or have additional questions regarding the MA PFML program, contact eBen today!