In October, the White House issued final regulations and a new IRS notice to eliminate the Affordable Care Act’s (ACA) “family glitch” at the beginning of 2023.

What is the family glitch?

The “glitch” refers to the fact that eligibility for subsidized coverage through the Marketplace for any member of a family (spouse and/or children) is based on whether or not an employee is offered “affordable” coverage by their employer. While simplifying employer compliance issues, this problem gave no relief to many people who were offered employer-sponsored health insurance facing the reality that the cost would be far more than the ACA intended – limiting the cost to 9.5% of their household income (as adjusted annually for inflation).

The “glitch” refers to the fact that eligibility for subsidized coverage through the Marketplace for any member of a family (spouse and/or children) is based on whether or not an employee is offered “affordable” coverage by their employer. While simplifying employer compliance issues, this problem gave no relief to many people who were offered employer-sponsored health insurance facing the reality that the cost would be far more than the ACA intended – limiting the cost to 9.5% of their household income (as adjusted annually for inflation).

What is considered affordable in 2023?

A plan is considered “affordable” if the plan’s premiums do not exceed 9.12% of the employee’s household income.

What has changed?

The internal Revenue Service issued new regulations that apply starting in Plan Year 2023. If a consumer has an offer of employer coverage that extends to their family members, the affordability of employer coverage for those family members will be based on the family premium amount, not the self-only employee premium cost. If the employee’s cost for dependent coverage exceeds the ACA’s affordability threshold, then the dependents may be eligible for subsidized individual exchange coverage.

Important points to understand:

- The rule does not impact your group plan or employee’s coverage, only dependents.

- This change will not affect the coverage affordability requirements for applicable large employers (ALEs) subject to the ACA’s employer shared responsibility provisions (the employer mandate).

- ALEs will NOT be required to offer affordable coverage to dependents.

How to calculate the dependent premium:

- Under the IRS rule, “family members” are individuals who will be on the same federal income tax return – so, an individual, plus their spouse if married and filing jointly, plus any dependents that they (and their spouse, if applicable) claim.

- The “family premium” is the premium for the lowest-cost employer plan that would cover all members of the tax household who are offered coverage by the employer.

- If the tax household includes just an employee and spouse, then the family premium is the lowest cost premium that would cover those two people, such as a “self plus one” plan option, if offered.

- If the tax household includes tax dependents, then the family premium is the one that would cover both the spouse (if there Is one) and all dependents who are offered employer coverage, even if those dependents aren’t seeking Marketplace coverage.

How will the cost be verified?

It is unclear how the IRS and the health insurance exchanges will verify the cost of employer-sponsored dependent coverage or if an employee has an affordable offer of employer-sponsored coverage based on their family income. However, the Biden Administration intends to revise the Exchange application on HealthCare.gov in advance of Open Enrollment for the 2023 plan year to include new questions about employer-sponsored coverage for family members.

What do employers need to do?

- Employers need to be aware of the change to the affordability standard for family coverage, be prepared to communicate with employees about the new rule, and be very clear about the exchange’s open enrollment deadline. ALEs, it is more important than ever to offer affordable, minimum value coverage to your full-time employees. The new regulation means that more employees will seek exchange-based coverage. With more employees participating in the exchange, the likelihood that an ALE will receive a penalty when they fail to offer employees affordable coverage increases. Employers with non-calendar plan years should consider adopting the changes to their Section 125 Cafeteria Plan that this new IRS guidance permits.

- If the employer’s plan year is not January 1st, you will need to amend your Section 125 Premium Only Plan document to allow dependents to come off the employer-sponsored plan outside of your plan year anniversary.

- Share with employees what the lowest-cost premium options are for self-only and family coverage.

- Provide employee communication as provided by eBen to your employees explaining this new regulation.

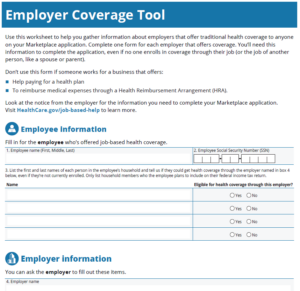

- eBen has an employer coverage tool that employees can use to gather the information that will be required as they apply through the Marketplace.

What should consumers do if they have an offer of coverage or are enrolled in employer coverage?

If a consumer qualifies for a Marketplace plan with a premium tax credit and wants to enroll in a Marketplace plan, the consumer should follow these steps with their employer:

- Consumers must be enrolled in a health plan through the Marketplace to use the tax credit to help pay for a health insurance premium.

- Consumers cannot use both a premium tax credit and enroll in their employer coverage for the same person.

- If they are not enrolled in the employer’s plan – once they have confirmed that they are eligible for a premium tax credit AND enrolled in Marketplace coverage, they should tell the employer they are declining or waiving the employer coverage.

- If they are enrolled in the employer’s plan but find out they qualify for Marketplace savings and want to switch; they will need to disenroll from employer coverage to enroll in a Marketplace plan with a tax credit.

How to help consumers navigate their coverage options.

Split coverage (employer and Marketplace):

The employee could enroll in their affordable employer coverage, while their APTC/CSR-eligible family members enroll in a Marketplace plan.

The employee could enroll in their affordable employer coverage, while their APTC/CSR-eligible family members enroll in a Marketplace plan.

- Families should keep in mind that this may mean they need to meet multiple deductibles and would have separate out-of-pocket maximums for each policy.

- Families should also keep in mind that the separate plans will have different provider networks and coverage for prescription drugs.

- If a consumer has already submitted an application with both the employee and their family members as applicants and wishes to pursue split coverage, they will need to update their application so that the employee is no longer seeking coverage in order to enroll only the employee’s family members (and not the employee) in a Marketplace plan. The consumer should report a life change and update the application so that the employee is included on the Marketplace application, but indicates they are not applying for coverage for themselves.

Marketplace coverage only:

The employee could decline their affordable employer coverage, and the whole family could enroll in a Marketplace plan.

- The family will pay full price for the employee’s portion of the Marketplace plan premium (If the employee’s self-only plan is considered affordable), while other family members’ portions would be lowered by using APTC.

- If the family members are eligible for CSTs, they will need to enroll in a Marketplace plan with a separate enrollment group from the employee in order to maintain their CSRs. The Marketplace will default the non-CSR-eligible employee and their CSR-eligible family members into separate enrollment groups. Families should keep in mind that each enrollment group will be tied to a policy with its own deductibles and out-of-pocket maximums.

Employer coverage only:

The whole family could enroll in the employee’s offer of employer-sponsored coverage.

- While someone is enrolled in employer coverage, they are not eligible for the premium tax credit or CSRs for a Marketplace plan.

Special Enrollment Periods

- Consumers should apply for 2023 Marketplace coverage during the Open Enrollment period beginning November 1, 2022.

- Consumers who are currently enrolled in in employer coverage and wish to drop It and enroll in a Marketplace plan should confirm with their employer that they can terminate their coverage before their Marketplace plan would start.

- Consumers who are enrolled in a job-based plan may qualify for a Special Enrollment Period (SEP) if they are determined newly eligible for APTC because their job-based plan no longer offers affordable coverage, and they drop their employer coverage. This applies to consumers whose coverage is no longer affordable due to the change in IRS rules. Consumers can access this SEP by attesting “Yes” to the application question that asks about losing qualifying health coverage and providing the date they can end their employer coverage or the date they lost It in the past.

Scenario #1: Affordability and APTC Eligibility

Meet Paul and Lisa.

Paul and Lisa are married and will file a joint tax return. Paul is offered coverage through his employer which extends to Lisa. All plans offered by his employer meet the minimum value standard. Lisa is not offered coverage through her employer. Paul and Lisa have an annual household income of $40,000.

Paul and Lisa are married and will file a joint tax return. Paul is offered coverage through his employer which extends to Lisa. All plans offered by his employer meet the minimum value standard. Lisa is not offered coverage through her employer. Paul and Lisa have an annual household income of $40,000.

The lowest-cost plan offered by Paul’s employer that would cover Paul only has a premium of $300 per month.

The lowest-cost plan offered by ABC Inc. that would cover Paul and Lisa has a premium of $500 per month.

For 2022, affordability and APTC eligibility for both Paul and Lisa is determined using the self-only premium for Paul. Since $300 is less than 9.61% of the couple’s income (the affordability percentage for 2022), the offer is considered affordable, and both Paul and Lisa are ineligible for the premium tax credit (PTC).

For 2023, we still use the self-only premium for Paul, but the family premium is for Lisa. Paul remains ineligible for APTC since $300 is less than 9.12% of the couple’s income.

However, Lisa is not eligible for APTC since $500 is more than 9.12% of their income, which means Lisa’s offer is considered unaffordable

Scenario #2: Application Completion

Meet Alex, Bailey, and Carly.

Meet Alex, Bailey, and Carly.

Alex and Bailey are married and have a child, Carly. Alex and Bailey will file a joint tax return and will claim Carly as a dependent. Both Alex and Bailey are offered coverage through their employer that extends to all 3 in their household. All plans offered by his employer meet the minimum value standard. Alex and Bailey have an annual household income of $90,000.

The lowest-cost plan offered by Alex’s employer that would cover Alex only has a premium of $100 per month. The lowest-cost family plan is $1,000 per month.

The lowest-cost plan offered by Bailey’s employer that would cover Bailey only has a monthly premium of $150 per month. The lowest cost family plan is $950 per month.

For 2022, affordability and APTC eligibility for Alex, Bailey, and Carly are determined using the self-only premium for Alex from that employer and Bailey from that employer. Since $100 and $150 are less than 9.61% of the couple’s income (the affordability percentage for 2022), the offer from both employers is considered affordable, and Alex, Bailey, and Carly are ineligible for the premium tax credit (PTC). Carly is not eligible because the employee-only costs for both plans are affordable.

For 2023, we still use the self-only premium for Alex from his employer and Bailey from her employer, but we will need to look at the family premium for Carly from both employers. Alex remains ineligible for APTC since $100 is less than 9.12% of the couple’s income. Bailey remains ineligible for APTC since $150 is less than 9.12% of the couple’s income.

However, Carly is now eligible for APTC since $950 and $1000 (cost of each employer’s lowest cost family plan) is more than 9.12% of their income, which means Carly’s offer on both parent’s plan is considered unaffordable and she will now be eligible for subsidized coverage through the Marketplace.

CMS.gov, October 27, 2022